Date: 23-07-2024

Overview

Our interactions with the digital world are very different now thanks to mobile applications. There is an app for practically anything, ranging from social networking and entertainment to banking and shopping. But this ease has a price: hackers are always coming up with new ways to take advantage of these apps' weaknesses. Fraudulent actions undermine user trust and harm a company's brand in addition to causing financial losses.

Businesses and mobile app developers are increasingly using AI-driven fraud detection solutions to reduce these risks. With its capacity to examine enormous volumes of data and spot trends, artificial intelligence (AI) is a potent instrument for promptly identifying and stopping fraud. In the case of top top restaurant app development company and MVP app development firms in India, where customer trust and security are critical, this is especially important.

Recognizing Mobile App Theft

A broad spectrum of malevolent actions targeted at taking advantage of holes in mobile applications are together referred to as mobile app fraud. Typical forms of fraud involving mobile apps include:

- Identity Theft: Online fraudsters use stolen personal data to open false accounts or obtain illegal access to already-existing ones.

- Payment Fraud: This refers to illicit activities, like making purchases with credit card details that have been stolen.

- App Installation Fraud: To boost figures and trick advertising, con artists falsify app installation stats.

- Account Takeover: Phishing or using weak passwords are two ways that hackers take over user accounts.

- Malware: To steal data or carry out unlawful acts, malicious software is installed into apps.

The intricacy of these attacks makes conventional rule-based fraud detection techniques ineffective in many cases. AI can help in this situation by providing sophisticated methods for identifying and preventing fraud.

AI's Function in Fraud Detection

The use of AI has changed the game in the fight against fraudulent mobile app downloads. Its capacity to instantly collect and analyze enormous volumes of data makes it a priceless tool for spotting and stopping fraudulent activity. The following are some significant ways AI helps in fraud detection:

- Anomaly Detection: AI systems are able to recognize odd patterns and behaviors that don't match the standard. AI can identify suspicious activity, for example, if a person suddenly initiates several high-value transactions from various places.

- Behavioral Analysis: AI is able to create a baseline of typical activities by analyzing user behavior over time. Alerts for additional research may be triggered by any departure from this baseline.

- Predictive Analytics: AI can anticipate possible fraud attempts and take proactive steps to stop them by evaluating past data.

- Machine Learning Models: Big datasets can be used to train algorithms that identify fraud-related patterns. Over time, these models continue to learn and get better.

- Natural Language Processing (NLP): Text-based data, including user reviews and feedback, can be analyzed using NLP to find possible fraud signs.

By integrating AI-driven fraud detection technologies, MVP app development firms in India and top restaurant app development companies may greatly improve security and increase user confidence.

AI Fraud Detection Methods

Mobile application fraud detection can be achieved through a variety of AI approaches. Every method has its own benefits and can be customized for particular applications. The following are a few of the most popular AI methods for spotting fraud:

- Supervised Learning - Labeled data is utilized to train machine learning models in supervised

learning. Based on past data, the model learns to differentiate between authentic and fraudulent activity. The model

can forecast the chance of fraud in fresh transactions once it has been trained.

Example: By examining characteristics like transaction amount, location, and time, a supervised learning model can be trained to recognize fraudulent credit card transactions.

- Unsupervised Learning - Algorithms for unsupervised learning do not need data that has been

tagged. Rather, they do not know what defines fraud beforehand; instead, they only look for patterns and anomalies

in the data. This is especially helpful in identifying fresh and developing fraud trends.

As an illustration, clustering algorithms can identify transactions that are suspicious of being fraudulent by grouping similar transactions together.

- Reinforcement Learning - This technique teaches an artificial intelligence agent to make choices

in response to input from its surroundings. By acting in ways that provide favorable results and refraining from

acts that produce unfavorable ones, the agent learns to maximize rewards.

Example: By continuously learning from its interactions with the system, a reinforcement learning agent can be utilized to optimize fraud detection algorithms.

- Deep Learning - Models for deep learning, such neural networks, can handle a lot of complicated

data. These models are able to spot complex linkages and patterns that conventional machine learning algorithms

would overlook.

Convolutional neural networks (CNNs) are a useful tool for image analysis and fraud detection, including the identification of forged identification documents or IDs.

- Hybrid Approaches - Integrating many AI algorithms can improve fraud detection systems' precision

and potency. For example, in a hybrid approach, anomaly detection might be accomplished through unsupervised

learning and initial detection using supervised learning.

As an illustration, a hybrid system can utilize unsupervised learning to find novel and emerging threats and supervised learning to recognize established fraud tendencies.

Putting AI-Powered Fraud Detection Systems in Place

Careful planning and implementation are necessary when implementing AI-based fraud detection systems. The following are the crucial actions needed to implement such systems:

- Data Gathering and Preparation - Gathering and preprocessing data from multiple sources,

including external databases, transaction logs, and user activity data, is the initial stage. To make sure that this

data is appropriate for analysis, it needs to be cleaned and transformed.

For instance: To give a more complete picture of user behavior, transaction data can be enhanced with further information like device and geolocation data.

- Feature Engineering - In feature engineering, pertinent characteristics that may be utilized to

train machine learning models are selected and created from the raw data. To increase the accuracy of fraud

detection models, this step is essential.

For instance, transaction data can be used to derive characteristics like user location, average transaction amount, and frequency.

- Model Training and Evaluation - To identify patterns linked to fraud, machine learning models are

trained on labeled data. The models' performance on fresh data is then assessed using metrics including precision,

recall, and F1-score.

As an illustration, a fraud detection model might be assessed using a different validation dataset after being trained on transaction data from the past.

- Model Deployment and Monitoring - The models can be implemented in a production setting after

they have been trained and assessed. Sustained observation is necessary to guarantee that the models continue to be

accurate and reflect changing fraud trends.

As an illustration, deployed models can be incorporated into the backend of a mobile app to offer real-time fraud alerts and detection.

- Model Improvement and Feedback Loop - Data on discovered fraud and user interactions are

continuously collected through the establishment of a feedback loop. The models are gradually trained again using

this data.

As an illustration, user input on false positives and negatives can be utilized to improve fraud detection algorithms and lower the number of false alarms.

Success Stories and Case Studies

To demonstrate the efficacy of artificial intelligence (AI) in detecting fraudulent activities, let us examine several real-life examples and triumphs:

- E-commerce Platform Case Study - A notable surge in fraudulent transactions was seen on an e-commerce platform, resulting in monetary losses and disgruntled customers. The platform was able to achieve a 90% reduction in fraudulent activity by putting in place an AI-based fraud detection system. The system recognized and blocked suspicious transactions in real-time using a combination of anomaly detection and supervised learning.

- Example Research: Banking Industry - To detect fraudulent transactions, a major bank used deep learning models. They saw a notable drop in false positives and an increase in fraud detection accuracy. Real-time fraud prevention was made possible by the models' ability to recognize intricate patterns in transaction data.

- Case Study: Restaurant App Development - To safeguard users' payment information and personal information, a top restaurant app development business in India integrated AI-based fraud detection technologies. User confidence increased as a result of this measure, which decreased payment fraud by 80%.

Conclusion

Mobile app fraud detection is now a critical responsibility for companies and developers due to the prevalence of fraudulent operations in the digital sphere. AI is a key weapon in the battle against fraud since it can evaluate massive volumes of data, spot trends, and provide predictions in real time. AI-based fraud detection solutions have a proven track record of effectiveness, as seen in the experiences of top restaurant app development companies and MVP app development companies in India. These businesses can secure their platforms, safeguard user data, and build user confidence by implementing these technologies.

Keeping ahead of fraudsters in the digital era necessitates ongoing adaptation and improvement. Businesses can improve their fraud detection capabilities, cut losses, and provide their consumers with a safer digital experience by utilizing AI.

```Your choice of weapon

Build your Apps for any Platform

Latest Blogs

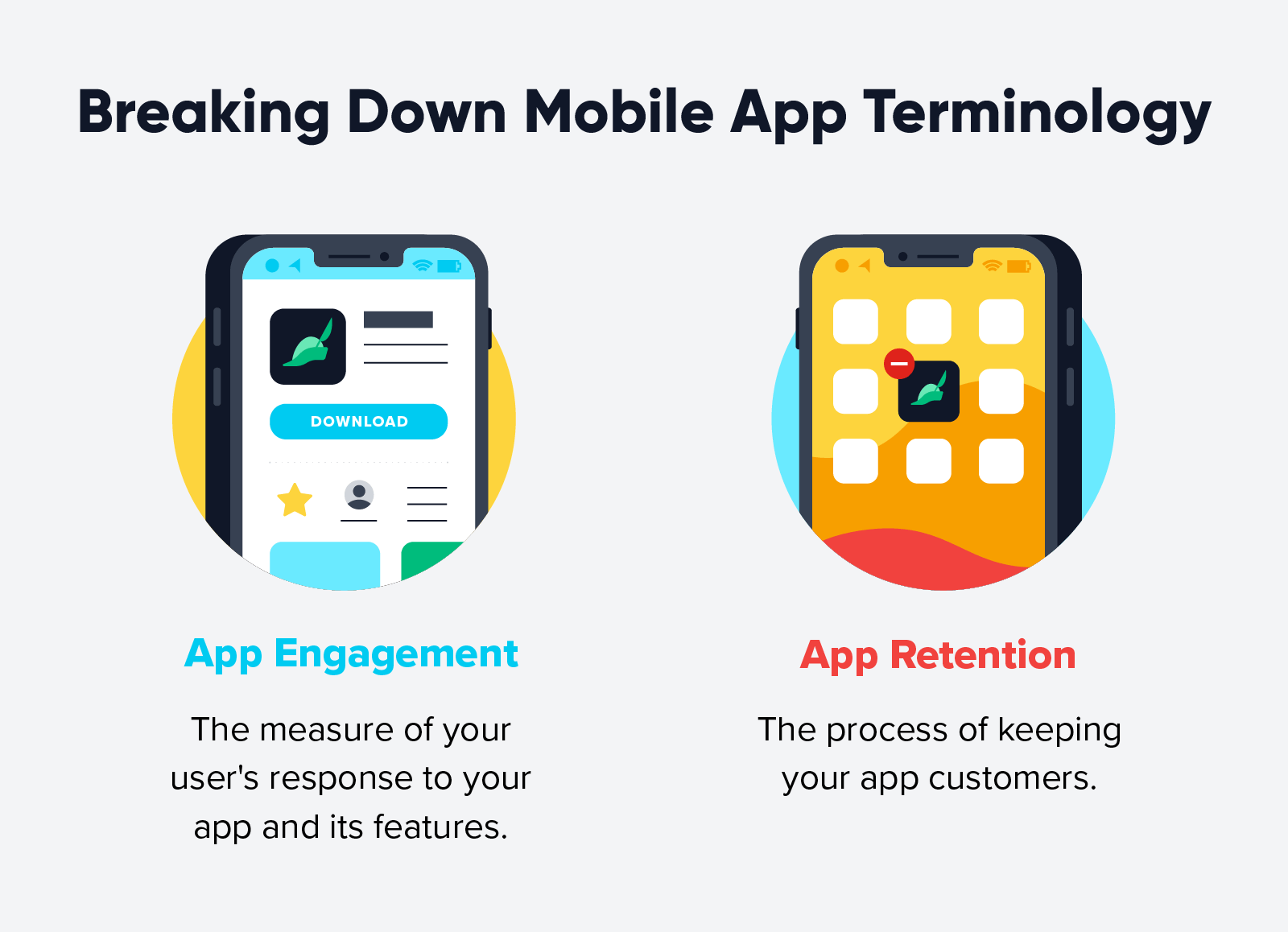

Leveraging Mobile Push Notifications: Strategies for User Engagement & Retention

Posted On: 11-Jun-2024

Category:

The Sharing Economy Dilemma: Balancing User Safety with Convenience

Posted On: 24-Jun-2024

Category:

Beyond the Likes Unlocking the True User Engagement Metrics for Your Mobile App

Posted On: 20-Jun-2024

Category:

Mobile App Security 101: Protecting User Data in a Digital Wild West

Posted On: 24-Jun-2024

Category:

Related Services

Tutor App Development Company | Custom Tutor App Development Solutions

Posted On: 21-Aug-2024

Category: elearning

Invoicing app development company| Invoicing app developer company

Posted On: 29-Sep-2024

Category: app development company

Top ECommerce App Development Company | ECommerce App Developers

Posted On: 29-Sep-2024

Category: ecommerce

We to code. It's our passion

you can also reach us at our given

email address or phone number.